2022 opened the door for private Russian investors to a new investment opportunity: they can now buy diamonds from banks, absolutely VAT-free. Now, Russia sees a new market for investment: diamonds. ALROSA Strategy Director Dmitry Amelkin talks about the rising popularity of diamonds as an investment, the future of the industry, and the ins and outs of ALROSA’s investment products.

How is the rough diamond and diamond industry doing? Anything new?

As you very well know, diamonds are unique and rare. They are created from rough diamonds, and there is a finite supply of them. Over the last few years, we have seen the supply suitable for cutting and polishing decline considerably, and it is not likely to ever be the way it used to. Yields have fallen as resources deplete, and mines are increasingly exhausted. Add to this the fact that no geological discoveries have been made in recent decades, and you can see the problem. The whole industry is still struggling, even having picked up after the 2019–2020 downturn, what with the industry crisis and the onset of the pandemic. The Kimberley Process estimated the global diamond production at 120 million carats in 2021. For those of you who do not know, the Kimberley Process is an internationally recognized rough diamond certification system. The figure is not likely to go lower or higher. To put this in perspective, there were 151 million carats produced in 2017, which was the decade’s high, so 120 million is 21% lower than the industry high over the decade.

On top of that, the demand for diamonds is soaring; they are extremely popular with rich people, especially in fast-growing Asian countries. Once in a while, we even face excess demand in the industry—when demand exceeds supply. The existing supply shortage is more likely to only be further amplified.

Are diamonds at all appealing as an investment?

Abroad, people have always invested in rare, large and colored diamonds. After all, according to our vernacular, a diamond is a compact, mobile physical asset with a maximum concentration of value per unit volume and mass. It does not require any special storage conditions; you do not need to register your ownership or its transfer.

People buy diamonds all the time, all over the world; that is how they diversify their portfolios. So it is only natural that the rough diamond market has always been monopolized, with no major players willing to unveil the secret behind rough diamond pricing. And why would they? It is a lot different now, though, a shoutout to ALROSA, a large independent major player that has a say in this market. There is also the fact that digital technology has advanced, bringing transparency to the whole diamond pricing business.

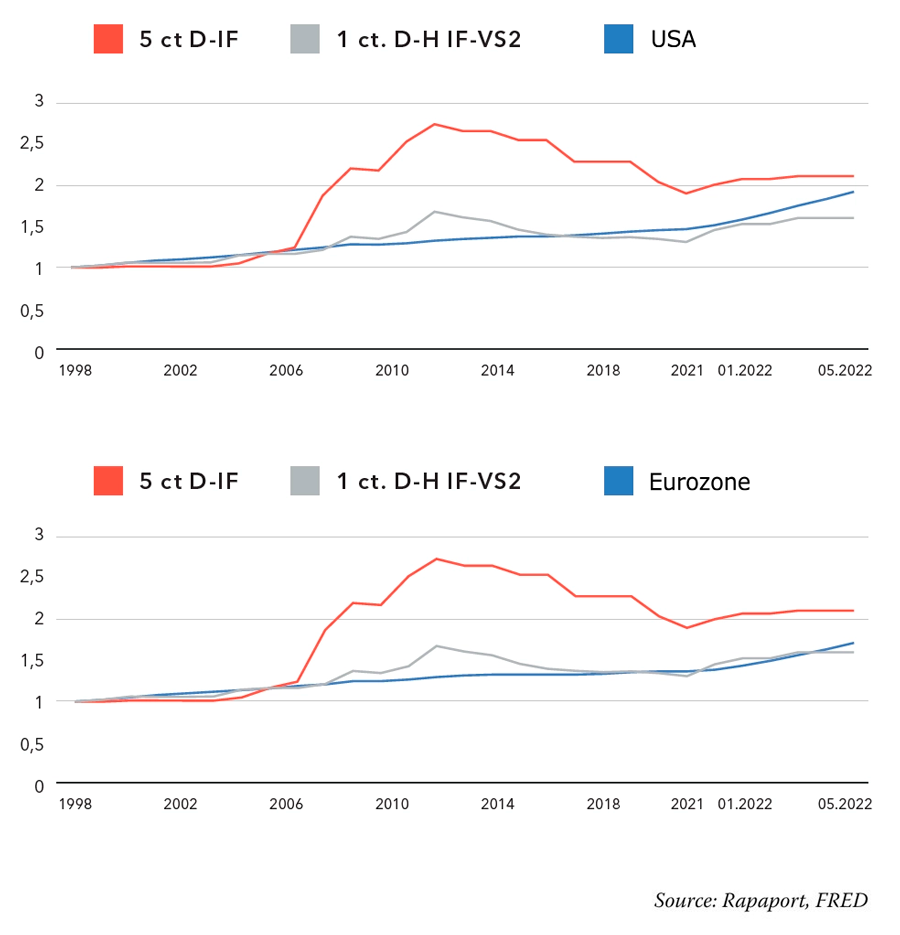

lnftation in the US and the Eurozone to the diamond price index

What does the future of this market look like in Russia?

Oh, it looks fantastic. Given the circumstances, ALROSA has been refocusing on the domestic market. We are now offering our investors the products we used to reserve for our foreign partners. It is in very high demand in Russia now! It also makes sense: when times are uncertain and inflation is high, people are always looking for new types of assets to protect their capital and diversify their portfolios. Diamonds look like a pretty safe haven here.

Don’t forget that in Russia, it is all a little bit more complicated in domestic terms: falling deposit rates, a shortage of available assets for investment and whatnot.

Given everything that is going on geopolitically, have you changed your sales destinations?

Sure. Our company is gaining traction in the domestic market. I believe it is understandable. It goes for both investment products and jewelry products. They say sanctions are a double-edged sword. On the one hand, our exports are on the sidelines right now. On the other, a lot of foreign companies are having difficulties importing diamonds from abroad, making them close down their businesses in Russia, thus giving us a competitive edge. We are now in our element in the domestic market. We have never been in this position before.

How big are diamonds as an investment?

This is just what we are focusing on right now. That, and boosting jewelry diamond sales. It is clear diamonds as an investment will be in high demand.

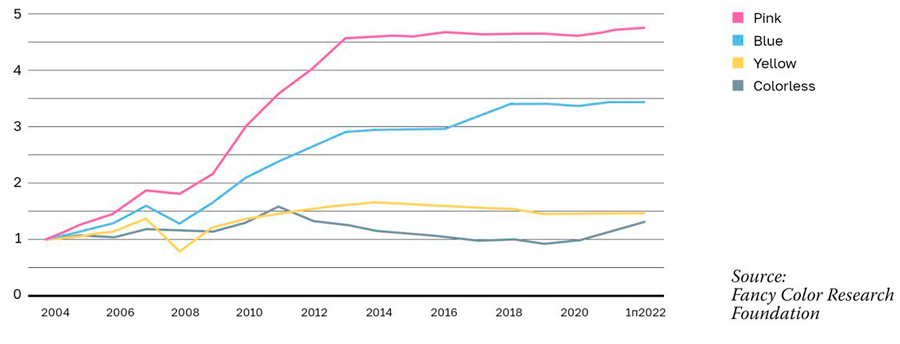

Comparative price inflation for all sizes of poLlshed diamonds since 2005

Since October 1st, 2022, ALROSA has been cooperating with banks to offer diamonds as an investment. What does it mean?

We talked to our partner banks and offered two products for their private clients. The first product is rare, one-of-a-kind diamonds, which have the greatest investment appeal. You won’t find diamonds like these anywhere: these are colorless and at least 2-carat. There are also some unique-colored diamonds. The second product is a “diamond basket”, if you will: sets of diamonds weighing 0.3 carats or more. The main feature is the resale opportunity: for example, you can auction off your rare diamond or sell it on the ALROSA trading platform. When it comes to diamond baskets, we can buy them back, provided we keep them. For the first investment product, the entry threshold is the ruble equivalent of $50k; for the second, it is $25k.

Banks can now sell diamonds to individuals VAT-free. Will the legislation changes help the diamond market?

Diamonds have traditionally been used as an investment to conserve capital. It is only logical that people have turned to diamonds yet again, given the circumstances. It began in March: we saw more and more Russian private investors contact us, looking to protect their capital, even though they had to pay a 20% VAT until October 1st. Now they do not have to, so talk about a great investment appeal!